That means you pay for credits to use for invoices (one credit), bills with line items extracted (two credits), bank statements (three credits per page) and so on. It’s a major benefit for someone like me who isn’t a strong number-cruncher.”ĪutoEntry uses a credit-based pricing model that’s billed as a monthly subscription.

#Wave receipts mobile app plus#

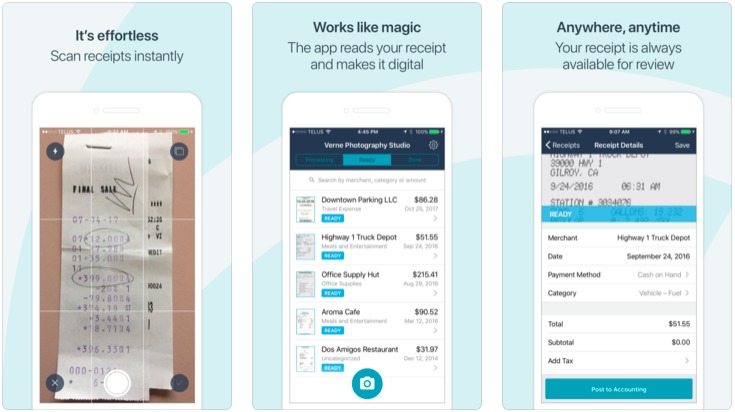

This is a huge plus because even the smallest human error can completely compromise accuracy and snowball into huge errors. Once uploaded, the system automatically extracts the numbers and inputs it into the system. I can scan receipts and invoices and have a digital copy in my phone in seconds.

#Wave receipts mobile app software#

“It syncs well with the most popular accounting software programs. “I currently use AutoEntry for managing and organizing all of my receipts,” he said. Glen Wilde, CEO and founder of Diet to Success, said that AutoEntry more than meets his company’s receipt-tracking needs. AutoEntry simplifies receipt scanning and organization.

The Growth Latter Plan includes features like expanded expense policy rules and per diems. Both plans include OCR scanning, mileage expense reporting and approval flow. It’s $9 per user per month for the Growth Plan, which covers more than 50 active users. Plans are billed annually and start at $7 per user per month for the Team plan, which covers up to 50 active users. “Rydoo is the best receipt-tracking tool because it is cloud-based, inexpensive, feature-rich, has OCR scanning capabilities, and allows enterprises to limit access according to employees’ roles and responsibilities,” he said. Rydoo is an inexpensive cloud-based option.īrian Patrick, home expert and CEO of Pest Strategies, said he relies on Rydoo for his company’s expense-tracking needs. “However, its unique selling proposition is that it can automate any possible expense tracking as long as it’s within the software’s current capabilities, including an estimated mileage usage for your vehicle using the wonders of GPS.” 2. “Manual entry is a thing of the past for users of Expensify because of the software’s SmartScan technology that automatically scans, inputs and tracks business expenses,” said Yaniv Masjedi, chief marketing officer at Nextiva. Most of the professionals we polled considered it a worthwhile investment because of how automated it is. Business plans have high-powered features like automatic expense reporting and company credit card monitoring. The service starts at $4.99 per month for individuals and $5 per user per month for business plans. “It does a lot of the heavy lifting for me, and it’s super simple and quick to use so I’m not up for days doing expense reports or taxes.” “Expensify does a great job of pre-organizing receipts, but you can organize them to your liking in the app as well,” said Tawnya Schultz, financial freedom coach at The Money Life Coach. In our conversations with small business owners, the name that popped up most consistently was Expensify. Expensify is a popular all-in-one solution. Here are the top three solutions that small business owners told us about, and a few others you might want to consider. To help you determine the best solution for your business, we examined what makes a good receipt-tracking app and asked business owners which ones they prefer.

#Wave receipts mobile app free#

There are many options for receipt-tracking apps, ranging from free apps with limited features to advanced ones that require a monthly subscription. Which receipt-tracking apps do small business owners prefer? A receipt app will save you from searching through a pile of receipts when doing your taxes.

0 kommentar(er)

0 kommentar(er)